PART 191 - DRAWBACK

Source:

T.D. 98-16, 63 FR 11006, Mar. 5, 1998, unless otherwise noted.

§ 191.0 Scope.

This part sets forth general provisions applicable to drawback claims and specialized provisions applicable to specific types of drawback claims filed under 19 U.S.C. 1313, prior to the February 24, 2016, amendments to the U.S. drawback law. Drawback claims may not be filed under this part after February 23, 2019. For drawback claims filed under 19 U.S.C. 1313, as amended, see part 190. Additional drawback provisions relating to the North American Free Trade Agreement (NAFTA) are contained in subpart E of part 181 of this chapter.

[USCBP-2018-0029, 83 FR 65064, Dec. 18, 2018]

§ 191.0a Claims filed under NAFTA.

Claims for drawback filed under the provisions of part 181 of this chapter shall be filed separately from claims filed under the provisions of this part.

Subpart A - General Provisions

§ 191.1 Authority of the Commissioner of CBP.

Pursuant to DHS Delegation number 7010.3, the Commissioner of CBP has the authority to prescribe, and pursuant to Treasury Department Order No. 100-16 (set forth in the appendix to part 0 of this chapter), the Secretary of the Treasury has the sole authority to approve, rules and regulations regarding drawback.

[USCBP-2018-0029, 83 FR 65064, Dec. 18, 2018]

§ 191.2 Definitions.

For the purposes of this part:

(a) Abstract. Abstract means the summary of the actual production records of the manufacturer.

(b) Act. Act, unless indicated otherwise, means the Tariff Act of 1930, as amended.

(c) Certificate of delivery. Certificate of delivery (see § 191.10 of this part) means Customs Form 7552, or its electronic equivalent, Delivery Certificate for Purposes of Drawback, summarizing information contained in original documents, establishing:

(1) The transfer from one party (transferor) to another (transferee) of:

(i) Imported merchandise;

(ii) Substituted merchandise under 19 U.S.C. 1313(j)(2);

(iii) A qualified article under 19 U.S.C. 1313(p)(2)(A)(ii) from the manufacturer or producer to the exporter or under 1313(p)(2)(A)(iv) from the importer to the exporter; or

(iv) Drawback product;

(2) The identity of such merchandise or article as being that to which a potential right to drawback exists; and

(3) The assignment of drawback rights for the merchandise or article transferred from the transferor to the transferee.

(d) Certificate of manufacture and delivery. Certificate of manufacture and delivery (see § 191.24 of this part) means Customs Form 7552, or its electronic equivalent, Delivery Certificate for Purposes of Drawback, summarizing information contained in original documents, establishing:

(1) The transfer of an article manufactured or processed under 19 U.S.C. 1313(a) or 1313(b) from one party (transferor) to another (transferee);

(2) The identity of such article as being that to which a potential right to drawback exists; and

(3) The assignment of drawback rights for the article transferred from the transferor to the transferee.

(e) Commercially interchangeable merchandise. Commercially interchangeable merchandise means merchandise which may be substituted under the substitution unused merchandise drawback law, § 313(j)(2) of the Act, as amended (19 U.S.C. 1313(j)(2)) (see § 191.32(b)(2) and (c) of this part), or under the provision for the substitution of finished petroleum derivatives, § 313(p), as amended (19 U.S.C. 1313(p)).

(f) Designated merchandise. Designated merchandise means either eligible imported duty-paid merchandise or drawback products selected by the drawback claimant as the basis for a drawback claim under 19 U.S.C. 1313(b) or (j)(2), as applicable, or qualified articles selected by the claimant as the basis for drawback under 19 U.S.C. 1313(p).

(g) Destruction. Destruction means the complete destruction of articles or merchandise to the extent that they have no commercial value.

(h) Direct identification drawback. Direct identification drawback means drawback authorized either under § 313(a) of the Act, as amended (19 U.S.C. 1313(a)), on imported merchandise used to manufacture or produce an article which is either exported or destroyed, or under § 313(j)(1) of the Act, as amended (19 U.S.C. 1313(j)(1)), on imported merchandise exported, or destroyed under Customs supervision, without having been used in the United States (see also §§ 313(c), (e), (f), (g), (h), and (q)). Merchandise or articles may be identified for purposes of direct identification drawback by use of the accounting methods provided for in § 191.14 of this subpart.

(i) Drawback. Drawback means the refund or remission, in whole or in part, of a customs duty, fee or internal revenue tax which was imposed on imported merchandise under Federal law because of its importation, and the refund of internal revenue taxes paid on domestic alcohol as prescribed in 19 U.S.C. 1313(d) (see also § 191.3 of this subpart).

(j) Drawback claim. Drawback claim means the drawback entry and related documents required by regulation which together constitute the request for drawback payment.

(k) Drawback entry. Drawback entry means the document containing a description of, and other required information concerning, the exported or destroyed article on which drawback is claimed. Drawback entries are filed on Customs Form 7551.

(l) Drawback product. A drawback product means a finished or partially finished product manufactured in the United States under the procedures in this part for manufacturing drawback. A drawback product may be exported, or destroyed under Customs supervision with a claim for drawback, or it may be used in the further manufacture of other drawback products by manufacturers or producers operating under the procedures in this part for manufacturing drawback, in which case drawback would be claimed upon exportation or destruction of the ultimate product. Products manufactured or produced from substituted merchandise (imported or domestic) also become “drawback products” when applicable substitution provisions of the Act are met. For purposes of § 313(b) of the Act, as amended (19 U.S.C. 1313(b)), drawback products may be designated as the basis for drawback or deemed to be substituted merchandise (see § 1313(b)). For a drawback product to be designated as the basis for drawback, the product must be associated with a certificate of manufacture and delivery (see § 191.24 of this part).

(m) Exportation; exporter —

(1) Exportation. Exportation means the severance of goods from the mass of goods belonging to this country, with the intention of uniting them with the mass of goods belonging to some foreign country. An exportation may be deemed to have occurred when goods subject to drawback are admitted into a foreign trade zone in zone-restricted status, or are laden upon qualifying aircraft or vessels as aircraft or vessel supplies in accordance with § 309(b) of the Act, as amended (19 U.S.C. 1309(b)) (see §§ 10.59 through 10.65 of this chapter).

(2) Exporter. Exporter means that person who, as the principal party in interest in the export transaction, has the power and responsibility for determining and controlling the sending of the items out of the United States. In the case of “deemed exportations” (see paragraph (m)(1) of this section), the exporter means that person who, as the principal party in interest in the transaction deemed to be an exportation, has the power and responsibility for determining and controlling the transaction (in the case of aircraft or vessel supplies under 19 U.S.C. 1309(b), the party who has the power and responsibility for lading the vessel supplies on the qualifying aircraft or vessel).

(n) Filing. Filing means the delivery to Customs of any document or documentation, as provided for in this part, and includes electronic delivery of any such document or documentation.

(o) Fungible merchandise or articles. Fungible merchandise or articles means merchandise or articles which for commercial purposes are identical and interchangeable in all situations.

(p) General manufacturing drawback ruling. A general manufacturing drawback ruling means a description of a manufacturing or production operation for drawback and the regulatory requirements and interpretations applicable to that operation (see § 191.7 of this subpart).

(q) Manufacture or production. Manufacture or production means:

(1) A process, including, but not limited to, an assembly, by which merchandise is made into a new and different article having a distinctive “name, character or use”; or

(2) A process, including, but not limited to, an assembly, by which merchandise is made fit for a particular use even though it does not meet the requirements of paragraph (q)(1) of this section.

(r) Multiple products. Multiple products mean two or more products produced concurrently by a manufacture or production operation or operations.

(s) Possession. Possession, for purposes of substitution unused merchandise drawback (19 U.S.C. 1313(j)(2)), means physical or operational control of the merchandise, including ownership while in bailment, in leased facilities, in transit to, or in any other manner under the operational control of, the party claiming drawback.

(t) Records. Records include, but are not limited to, statements, declarations, documents and electronically generated or machine readable data which pertain to the filing of a drawback claim or to the information contained in the records required by Chapter 4 of Title 19, United States Code, in connection with the filing of a drawback claim and which are normally kept in the ordinary course of business (see 19 U.S.C. 1508).

(u) Relative value. Relative value means, except for purposes of § 191.51(b), the value of a product divided by the total value of all products which are necessarily manufactured or produced concurrently in the same operation. Relative value is based on the market value, or other value approved by Customs, of each such product determined as of the time it is first separated in the manufacturing or production process. Market value is generally measured by the selling price, not including any packaging, transportation, or other identifiable costs, which accrue after the product itself is processed. Drawback law requires the apportionment of drawback to each such product based on its relative value at the time of separation.

(v) Schedule. A schedule means a document filed by a drawback claimant, under § 313(a) or (b), as amended (19 U.S.C. 1313(a) or (b)), showing the quantity of imported or substituted merchandise used in or appearing in each article exported or destroyed for drawback.

(w) Specific manufacturing drawback ruling. A specific manufacturing drawback ruling means a letter of approval issued by Customs Headquarters in response to an application, by a manufacturer or producer for a ruling on a specific manufacturing or production operation for drawback, as described in the format used. Synopses of approved specific manufacturing drawback rulings are published in the Customs Bulletin with each synopsis being published under an identifying Treasury Decision. Specific manufacturing drawback rulings are subject to the provisions in part 177 of this chapter.

(x) Substituted merchandise or articles. Substituted merchandise or articles means merchandise or articles that may be substituted under 19 U.S.C. 1313(b), 1313(j)(2), or 1313(p) as follows:

(1) Under § 1313(b), substituted merchandise must be of the same kind and quality as the imported designated merchandise or drawback product, that is, the imported designated merchandise or drawback products and the substituted merchandise must be capable of being used interchangeably in the manufacture or production of the exported or destroyed articles with no substantial change in the manufacturing or production process;

(2) Under § 1313(j)(2), substituted merchandise must be commercially interchangeable with the imported designated merchandise; and

(3) Under § 1313(p), a substituted article must be of the same kind and quality as the qualified article for which it is substituted, that is, the articles must be commercially interchangeable or described in the same 8-digit HTSUS tariff classification.

(y) Verification. Verification means the examination of any and all records, maintained by the claimant, or any party involved in the drawback process, which are required by the appropriate Customs officer to render a meaningful recommendation concerning the drawback claimant's conformity to the law and regulations and the determination of supportability, correctness, and validity of the specific claim or groups of claims being verified.

[T.D. 98-16, 63 FR 11006, Mar. 5, 1998; 63 FR 15288, Mar. 31, 1998, as amended by T.D. 01-18, 66 FR 9649, Feb. 9, 2001; CBP Dec. 15-14, 80 FR 61292, Oct. 13, 2015]]

§ 191.3 Duties, taxes, and fees subject or not subject to drawback.

(a) Duties and fees subject to drawback include:

(1) All ordinary Customs duties, including:

(i) Duties paid on an entry, or withdrawal from warehouse, for consumption for which liquidation has become final;

(ii) Estimated duties paid on an entry, or withdrawal from warehouse, for consumption, for which liquidation has not become final, subject to the conditions and requirements of § 191.81(b) of this subpart; and

(iii) Tenders of duties after liquidation of the entry, or withdrawal from warehouse, for consumption for which the duties are paid, subject to the conditions and requirements of § 191.81(c) of this part, including:

(A) Voluntary tenders (for purposes of this section, a “voluntary tender” is a payment of duties on imported merchandise in excess of duties included in the liquidation of the entry, or withdrawal from warehouse, for consumption, provided that the liquidation has become final and that the other conditions of this section and § 191.81 of this part are met);

(B) Tenders of duties in connection with notices of prior disclosure under 19 U.S.C. 1592(c)(4); and

(C) Duties restored under 19 U.S.C. 1592(d).

(2) Marking duties assessed under § 304(c), Tariff Act of 1930, as amended (19 U.S.C. 1304(c));

(3) Internal revenue taxes which attach upon importation (see § 101.1 of this chapter);

(4) Merchandise processing fees (see § 24.23 of this chapter) for unused merchandise drawback pursuant to 19 U.S.C. 1313(j), and drawback for substitution of finished petroleum derivatives pursuant to 19 U.S.C. 1313(p)(2)(A)(iii) or (iv); and

(5) Harbor maintenance taxes (see § 24.24 of this chapter) for unused merchandise drawback pursuant to 19 U.S.C. 1313(j), and drawback for substitution of finished petroleum derivatives pursuant to 19 U.S.C. 1313(p)(2)(A)(iii) or (iv).

(b) Duties and fees not subject to drawback include:

(1) Harbor maintenance taxes (see § 24.24 of this chapter) except where unused merchandise drawback pursuant to 19 U.S.C. 1313(j) or drawback for substitution of finished petroleum derivatives pursuant to 19 U.S.C. 1313(p)(2)(A)(iii) or (iv) is claimed;

(2) Merchandise processing fees (see § 24.23 of this chapter), except where unused merchandise drawback pursuant to 19 U.S.C. 1313(j) or drawback for substitution of finished petroleum derivatives pursuant to 19 U.S.C. 1313(p)(2)(A)(iii) or (iv) is claimed; and

(3) Antidumping and countervailing duties on merchandise entered, or withdrawn from warehouse, for consumption on or after August 23, 1988.

(c) No drawback shall be allowed when the identified merchandise, the designated imported merchandise, or the substituted other merchandise (when applicable), consists of an agricultural product which is duty-paid at the over-quota rate of duty established under a tariff-rate quota, except that:

(1) Agricultural products as described in this paragraph are eligible for drawback under 19 U.S.C. 1313(j)(1); and

(2) Tobacco otherwise meeting the description of agricultural products in this paragraph is eligible for drawback under 19 U.S.C. 1313(j)(1) or 19 U.S.C. 1313(a).

[T.D. 98-16, 63 FR 11006, Mar. 5, 1998; 63 FR 27489, May 19, 1998, as amended by T.D. 01-18, 66 FR 9649, Feb. 9, 2001; CBP Dec. 04-33, 69 FR 60083, Oct. 7, 2004; USCBP-2018-0029, 83 FR 65064, Dec. 18, 2018]

§ 191.4 Merchandise in which a U.S. Government interest exists.

(a) Restricted meaning of Government. A U.S. Government instrumentality operating with nonappropriated funds is considered a Government entity within the meaning of this section.

(b) Allowance of drawback. If the merchandise is sold to the U.S. Government, drawback shall be available only to the:

(1) Department, branch, agency, or instrumentality of the U.S. Government which purchased it; or

(2) Supplier, or any of the parties specified in § 191.82 of this part, provided the claim is supported by documentation signed by a proper officer of the department, branch, agency, or instrumentality concerned certifying that the right to drawback was reserved by the supplier or other parties with the knowledge and consent of the department, branch, agency, or instrumentality.

(c) Bond. No bond shall be required when a United States Government entity claims drawback.

§ 191.5 Guantanamo Bay, insular possessions, trust territories.

Guantanamo Bay Naval Station is considered foreign territory for drawback purposes and, accordingly, drawback may be permitted on articles shipped there. Drawback is not allowed, except on claims made under 19 U.S.C. 1313(j)(1), on articles shipped to the U.S. Virgin Islands, American Samoa, Wake Island, Midway Islands, Kingman Reef, Guam, Canton Island, Enderbury Island, Johnston Island, or Palmyra Island. Puerto Rico is not considered foreign territory for drawback purposes and, accordingly, drawback may not be permitted on articles shipped there from elsewhere in the customs territory of the United States.

[USCBP-2018-0029, 83 FR 65064, Dec. 18, 2018]

§ 191.6 Authority to sign drawback documents.

(a) Documents listed in paragraph (b) of this section shall be signed only by one of the following:

(1) The president, a vice-president, secretary, treasurer, or any other employee legally authorized to bind the corporation;

(2) A full partner of a partnership;

(3) The owner of a sole proprietorship;

(4) Any employee of the business entity with a power of attorney;

(5) An individual acting on his or her own behalf; or

(6) A licensed Customs broker with a power of attorney.

(b) The following documents require execution in accordance with paragraph (a) of this section:

(1) Drawback entries;

(2) Certificates of delivery;

(3) Certificates of manufacture and delivery;

(4) Notices of Intent to Export, Destroy, or Return Merchandise for Purposes of Drawback;

(5) Certifications of exporters on bills of lading or evidence of exportation (see §§ 191.28 and 191.82 of this part); and

(6) Abstracts, schedules and extracts from monthly abstracts if not included as part of a drawback claim.

(c) The following documents (see also part 177 of this chapter) may be executed by one of the persons described in paragraph (a) of this section or by any other individual legally authorized to bind the person (or entity) for whom the document is executed:

(1) A letter of notification of intent to operate under a general manufacturing drawback ruling under § 191.7 of this part;

(2) An application for a specific manufacturing drawback ruling under § 191.8 of this part;

(3) A request for a nonbinding predetermination of commercial interchangeability under § 191.32(c) of this part;

(4) An application for waiver of prior notice under § 191.91 of this part;

(5) An application for approval of accelerated payment of drawback under § 191.92 of this part; and

(6) An application for certification in the Drawback Compliance Program under § 191.193 of this part.

[T.D. 98-16, 63 FR 11006, Mar. 5, 1998; 63 FR 15288, Mar. 31, 1998; 63 FR 27489, May 19, 1998]

§ 191.7 General manufacturing drawback ruling.

(a) Purpose; eligibility. General manufacturing drawback rulings are designed to simplify drawback for certain common manufacturing operations but do not preclude or limit the use of applications for specific manufacturing drawback rulings (see § 191.8). A manufacturer or producer engaged in an operation that falls within a published general manufacturing drawback ruling may submit a letter of notification of intent to operate under that general ruling. Where a separately-incorporated subsidiary of a parent corporation is engaged in manufacture or production for drawback, the subsidiary is the proper party to submit the letter of notification, and cannot operate under a letter of notification submitted by the parent corporation.

(b) Procedures —

(1) Publication. General manufacturing drawback rulings are contained in appendix A to this part. As deemed necessary by Customs, new general manufacturing drawback rulings will be issued as Treasury Decisions and added to the appendix thereafter.

(2) Submission —

(i) Where filed. Letters of notification of intent to operate under a general manufacturing drawback ruling shall be submitted to any drawback office where drawback entries will be filed and liquidated, provided that the general manufacturing drawback ruling will be followed without variation. If there is any variation in the general manufacturing drawback ruling, the manufacturer or producer shall apply for a specific manufacturing drawback ruling under § 191.8 of this subpart.

(ii) Copies. Letters of notification of intent shall be submitted in duplicate unless claims are to be filed at more than one drawback office, in which case one additional copy of the letter of notification shall be filed for each additional office. Upon issuance of a letter of acknowledgment (paragraph (c)(1) of this section), the drawback office with which the letter of notification is submitted shall forward the additional copy to such additional office(s), with a copy of the letter of acknowledgment.

(3) Information required. Each manufacturer or producer submitting a letter of notification of intent to operate under a general manufacturing drawback ruling under this section must provide the following specific detailed information:

(i) Name and address of manufacturer or producer (if the manufacturer or producer is a separately-incorporated subsidiary of a corporation, the subsidiary corporation must submit a letter of notification in its own name);

(ii) In the case of a business entity, the names of the persons listed in § 191.6(a)(1) through (6) who will sign drawback documents;

(iii) Locations of the factories which will operate under the letter of notification;

(iv) Identity (by T.D. number and title) of the general manufacturing drawback ruling under which the manufacturer or producer will operate;

(v) Description of the merchandise and articles, unless specifically described in the general manufacturing drawback ruling;

(vi) Description of the manufacturing or production process, unless specifically described in the general manufacturing drawback ruling;

(vii) Basis of claim used for calculating drawback; and

(viii) IRS (Internal Revenue Service) number (with suffix) of the manufacturer or producer.

(c) Review and action by CBP. The drawback office to which the letter of notification of intent to operate under a general manufacturing drawback ruling was submitted shall review the letter of notification of intent.

(1) Acknowledgment. The drawback office shall promptly issue a letter of acknowledgment, acknowledging receipt of the letter of intent and authorizing the person to operate under the identified general manufacturing drawback ruling, subject to the requirements and conditions of that general manufacturing drawback ruling and the law and regulations, to the person who submitted the letter of notification if:

(i) The letter of notification is complete (i.e., containing the information required in paragraph (b)(3) of this section);

(ii) The general manufacturing drawback ruling identified by the manufacturer or producer is applicable to the manufacturing or production process;

(iii) The general manufacturing drawback ruling identified by the manufacturer or producer is followed without variation; and

(iv) The described manufacturing or production process is a manufacture or production under § 191.2(q) of this subpart.

(2) Computer-generated number. With the letter of acknowledgment the drawback office shall include the unique computer-generated number assigned to the acknowledgment of the letter of notification of intent to operate. This number must be stated when the person files manufacturing drawback claims with Customs under the general manufacturing drawback ruling.

(3) Non-conforming letters of notification of intent. If the letter of notification of intent to operate does not meet the requirements of paragraph (c)(1) of this section in any respect, the drawback office shall promptly and in writing specifically advise the person of this fact and why this is so. A letter of notification of intent to operate which is not acknowledged may be resubmitted to the drawback office with which it was initially submitted with modifications and/or explanations addressing the reasons given for non-acknowledgment, or the matter may be referred (by letter from the manufacturer or producer) to CBP Headquarters (Attention: Entry Process and Duty Refunds Branch, Regulations and Rulings, Office of International Trade).

(d) Duration. Acknowledged letters of notification under this section shall remain in effect under the same terms as provided for in § 191.8(h) for specific manufacturing drawback rulings.

§ 191.8 Specific manufacturing drawback ruling.

(a) Applicant. Unless operating under a general manufacturing drawback ruling (see § 191.7), each manufacturer or producer of articles intended to be claimed for drawback shall apply for a specific manufacturing drawback ruling. Where a separately-incorporated subsidiary of a parent corporation is engaged in manufacture or production for drawback, the subsidiary is the proper party to apply for a specific manufacturing drawback ruling, and cannot operate under any specific manufacturing drawback ruling approved in favor of the parent corporation.

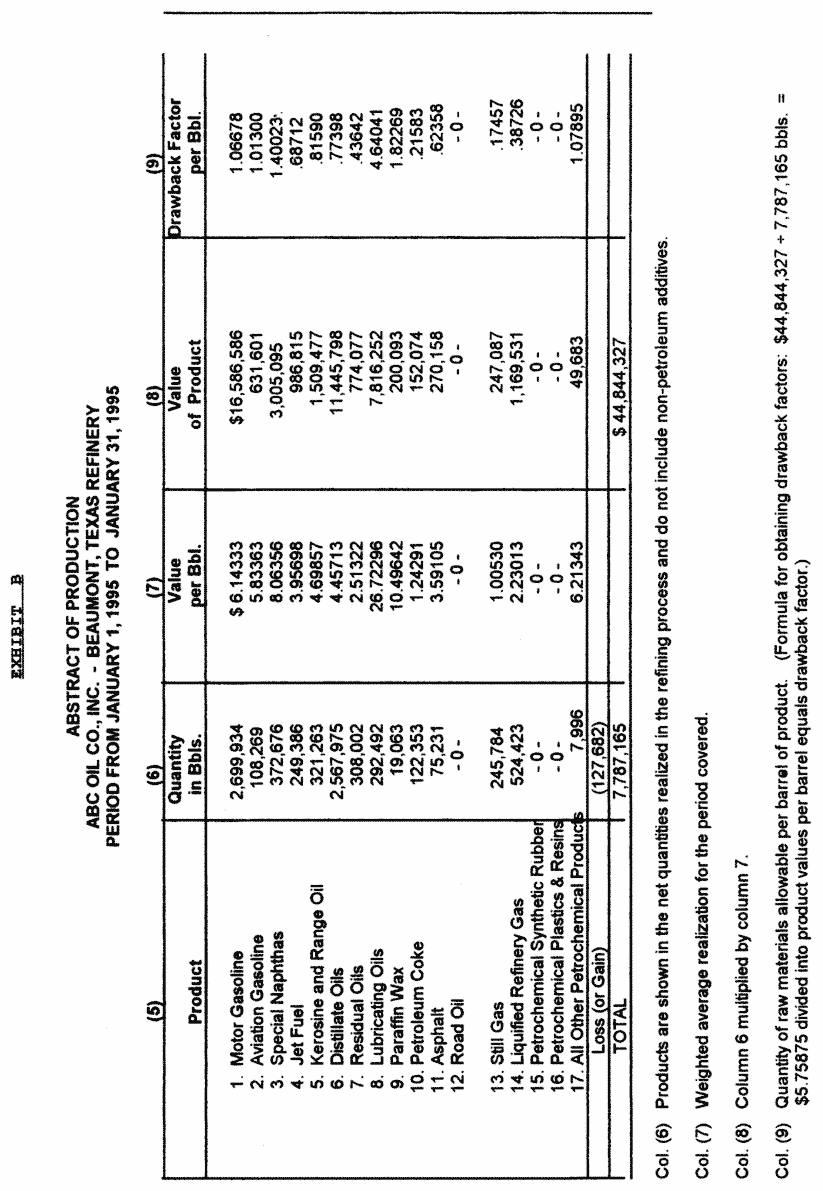

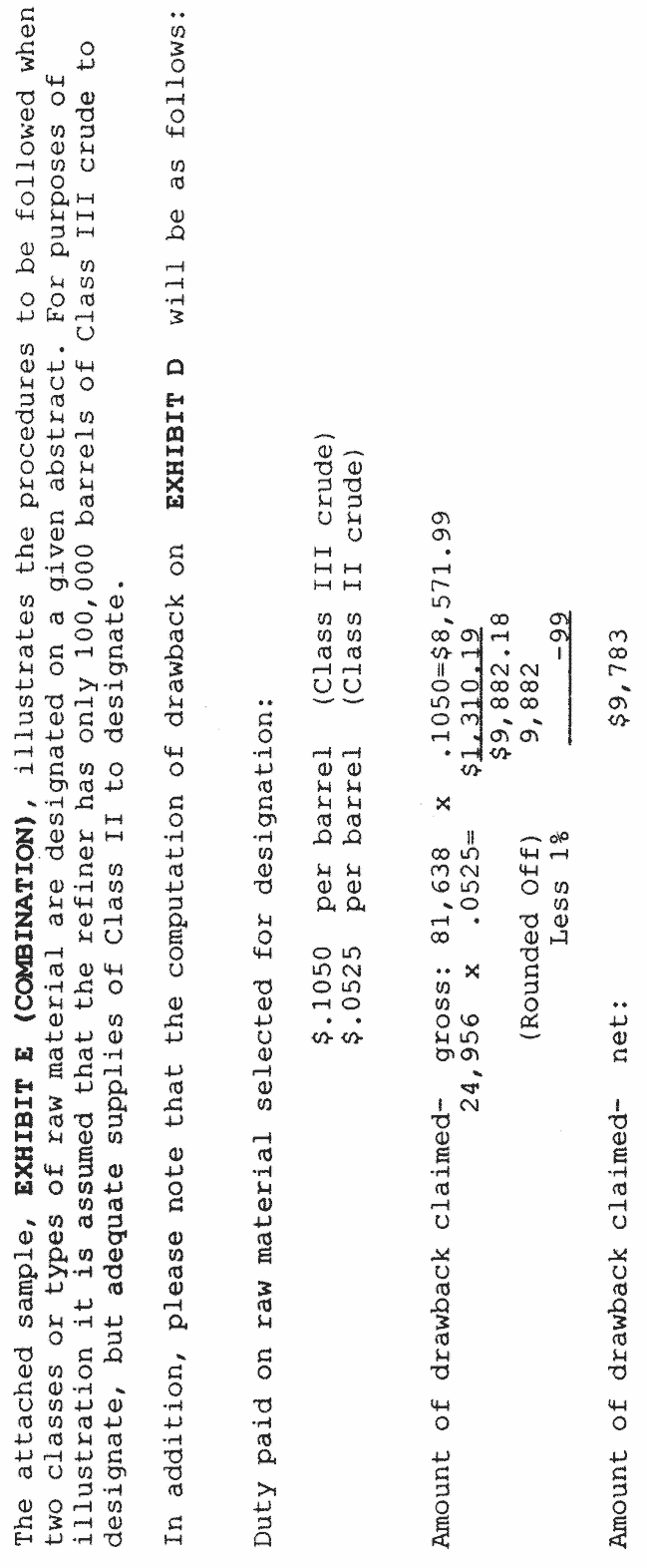

(b) Sample application. Sample formats for applications for specific manufacturing drawback rulings are contained in appendix B to this part.

(c) Content of application. The application of each manufacturer or producer shall include the following information as applicable:

(1) Name and address of the applicant;

(2) Internal Revenue Service (IRS) number (with suffix) of the applicant;

(3) Description of the type of business in which engaged;

(4) Description of the manufacturing or production process, which shows how the designated and substituted merchandise are used to make the article that is to be exported or destroyed;

(5) In the case of a business entity, the names of persons listed in § 191.6(a)(1) through (6) who will sign drawback documents;

(6) Description of the imported merchandise including specifications;

(7) Description of the exported article;

(8) Basis of claim for calculating manufacturing drawback;

(9) Summary of the records kept to support claims for drawback; and

(10) Identity and address of the recordkeeper if other than the claimant.

(d) Submission. An application for a specific manufacturing drawback ruling shall be submitted, in triplicate, to CBP Headquarters (Attention: Entry Process and Duty Refunds Branch, Regulations and Rulings, Office of International Trade). If drawback claims are to be filed under the ruling at more than one drawback office, one additional copy of the application shall be filed with CBP Headquarters for each additional office.

(e) Review and action by CBP. CBP Headquarters shall review the application for a specific manufacturing drawback ruling.

(1) Approval. If consistent with the drawback law and regulations, Customs Headquarters shall issue a letter of approval to the applicant and shall forward 1 copy of the application for the specific manufacturing drawback ruling to the appropriate drawback office(s) with a copy of the letter of approval. Synopses of approved specific manufacturing drawback rulings shall be published in the weekly Customs Bulletin with each synopsis being published under an identifying Treasury Decision (T.D.). Each specific manufacturing drawback ruling shall be assigned a unique computer-generated manufacturing number which shall be included in the letter of approval to the applicant from Customs Headquarters, shall appear in the published synopsis, and must be used when filing manufacturing drawback claims with Customs.

(2) Disapproval. If not consistent with the drawback law and regulations, CBP Headquarters shall promptly and in writing inform the applicant that the application cannot be approved and shall specifically advise the applicant why this is so. A disapproved application may be resubmitted with modifications and/or explanations addressing the reasons given for disapproval, or the disapproval may be appealed to CBP Headquarters (Attention: Director, Entry Process and Duty Refunds Branch, Regulations and Rulings, Office of International Trade).

(f) Schedules and supplemental schedules. When an application for a specific manufacturing drawback ruling states that drawback is to be based upon a schedule filed by the manufacturer or producer, the schedule will be reviewed by Customs Headquarters. The application may include a request for authorization for the filing of supplemental schedules with the drawback office where claims are filed.

(g) Procedure to modify a specific manufacturing drawback ruling —

(1) Supplemental application. Except as provided for limited modifications in paragraph (g)(2) of this section, a manufacturer or producer desiring to modify an existing specific manufacturing drawback ruling shall submit a supplemental application for such a ruling to CBP Headquarters (Attention: Entry Process and Duty Refunds Branch, Regulations and Rulings, Office of International Trade). Such a supplemental application may, at the discretion of the manufacturer or producer, be in the form of the original application, or it may identify the specific manufacturing drawback ruling to be modified (by T.D. number and unique computer-generated number) and include only those paragraphs of the application to be modified, with a statement that all other paragraphs are unchanged and are incorporated by reference in the supplemental application.

(2) Limited modifications.

(i) A supplemental application for a specific manufacturing drawback ruling shall be submitted to the drawback office(s) where claims are filed if the modifications are limited to:

(A) The location of a factory, or the addition of one or more factories where the methods followed and records maintained are the same as those at another factory operating under the existing specific manufacturing drawback ruling of the manufacturer or producer;

(B) The succession of a sole proprietorship, partnership or corporation to the operations of a manufacturer or producer;

(C) A change in name of the manufacturer or producer;

(D) A change in the persons who will sign drawback documents in the case of a business entity;

(E) A change in the basis of claim used for calculating drawback;

(F) A change in the decision to use or not to use an agent under § 191.9 of this chapter, or a change in the identity of an agent under that section;

(G) A change in the drawback office where claims will be filed under the ruling (see paragraph (g)(2)(iii) of this section); or

(H) Any combination of the foregoing changes.

(ii) A limited modification, as provided for in this paragraph, shall contain only the modifications to be made, in addition to identifying the specific manufacturing drawback ruling and being signed by an authorized person. To effect a limited modification, the manufacturer or producer shall file with the drawback office(s) where claims are filed (with a copy to CBP Headquarters, Attention, Entry Process and Duty Refunds Branch, Regulations and Rulings, Office of International Trade) a letter stating the modifications to be made. The drawback office shall promptly acknowledge, in writing, acceptance of the limited modifications, with a copy to CBP Headquarters, Attention, Entry Process and Duty Refunds Branch, Regulations and Rulings, Office of International Trade.

(iii) To effect a change in the drawback office where claims will be filed, the manufacturer or producer shall file with the new drawback office where claims will be filed, a written application to file claims at that office, with a copy of the application and approval letter under which claims are currently filed. The manufacturer or producer shall provide a copy of the written application to file claims at the new drawback office to the drawback office where claims are currently filed.

(h) Duration. Subject to 19 U.S.C. 1625 and part 177 of this chapter, a specific manufacturing drawback ruling under this section shall remain in effect indefinitely unless:

(1) No drawback claim or certificate of manufacture and delivery is filed under the ruling for a period of 5 years and notice of termination is published in the Customs Bulletin; or

(2) The manufacturer or producer to whom approval of the ruling was issued files a request to terminate the ruling, in writing, with Customs Headquarters.

[T.D. 98-16, 63 FR 11006, Mar. 5, 1998; 63 FR 15288, Mar. 31, 1998]

§ 191.9 Agency.

(a) General. An owner of the identified merchandise, the designated imported merchandise and/or the substituted other merchandise that is used to produce the exported articles may employ another person to do part, or all, of the manufacture or production under 19 U.S.C. 1313(a) or (b) and § 191.2(q) of this subpart. For purposes of this section, such owner is the principal and such other person is the agent. Under 19 U.S.C. 1313(b), the principal shall be treated as the manufacturer or producer of merchandise used in manufacture or production by the agent. The principal must be able to establish by its manufacturing records, the manufacturing records of its agent(s), or the manufacturing records of both (or all) parties, compliance with all requirements of this part (see, in particular, § 191.26 of this part).

(b) Requirements —

(1) Contract. The manufacturer must establish that it is the principal in a contract between it and its agent who actually does the work on either the designated or substituted merchandise, or both, for the principal. The contract must include:

(i) Terms of compensation to show that the relationship is an agency rather than a sale;

(ii) How transfers of merchandise and articles will be recorded by the principal and its agent;

(iii) The work to be performed on the merchandise by the agent for the principal;

(iv) The degree of control that is to be exercised by the principal over the agent's performance of work;

(v) The party who is to bear the risk of loss on the merchandise while it is in the agent's custody; and

(vi) The period that the contract is in effect.

(2) Ownership of the merchandise by the principal. The records of the principal and/or the agent must establish that the principal had legal and equitable title to the merchandise before receipt by the agent. The right of the agent to assert a lien on the merchandise for work performed does not derogate the principal's ownership interest under this section.

(3) Sales prohibited. The relationship between the principal and agent must not be that of a seller and buyer. If the parties' records show that, with respect to the merchandise that is the subject of the principal-agent contract, the merchandise is sold to the agent by the principal, or the articles manufactured by the agent are sold to the principal by the agent, those records are inadequate to establish existence of a principal-agency relationship under this section.

(c) Specific manufacturing drawback rulings; general manufacturing drawback rulings —

(1) Owner. An owner who intends to operate under the principal-agent procedures of this section must state that intent in any letter of notification of intent to operate under a general manufacturing drawback ruling filed under § 191.7 of this subpart or in any application for a specific manufacturing drawback ruling filed under § 191.8 of this subpart.

(2) Agent. Each agent operating under this section must have filed a letter of notification of intent to operate under a general manufacturing drawback ruling (see § 191.7), for an agent, covering the articles manufactured or produced, or have obtained a specific manufacturing drawback ruling (see § 191.8), as appropriate.

(d) Certificate; Drawback entry; Certificate of manufacture and delivery —

(1) Contents of certificate; when filing not required. Principals and agents operating under this section are not required to file a certificate of delivery (for the merchandise transferred from the principal to the agent) or a certificate of manufacture and delivery (for the articles transferred from the agent to the principal). The principal for whom processing is conducted under this section shall file, with any drawback claim or certificate of manufacture and delivery based on an article manufactured or produced under the principal-agent procedures in this section, a certificate, subject to the recordkeeping requirements of §§ 191.15 of this subpart and 191.26 of this part, certifying that upon request by Customs it can establish the following:

(i) Quantity, kind and quality of merchandise transferred from the principal to the agent;

(ii) Date of transfer of the merchandise from the principal to the agent;

(iii) Date of manufacturing or production operations performed by the agent;

(iv) Total quantity and description of merchandise appearing in or used in manufacturing or production operations performed by the agent;

(v) Total quantity and description of articles produced in manufacturing or production operations performed by the agent;

(vi) Quantity, kind and quality of articles transferred from the agent to the principal; and

(vii) Date of transfer of the articles from the agent to the principal.

(2) Blanket certificate. The certificate required under paragraph (d)(1) of this section may be a blanket certificate for a particular kind and quality of merchandise for a stated period.

§ 191.10 Certificate of delivery.

(a) Purpose; when required. A party who: imports and pays duty on imported merchandise; receives imported merchandise; in the case of 19 U.S.C. 1313(j)(2), receives imported merchandise, commercially interchangeable merchandise, or any combination of imported and commercially interchangeable merchandise; or receives an article manufactured or produced under 19 U.S.C. 1313(a) and/or (b): may transfer such merchandise or manufactured article to another party. The party shall record this transfer by preparing and issuing in favor of such other party a certificate of delivery, certified by the importer or other party through whose possession the merchandise or manufactured article passed (see paragraph (c) of this section). A certificate of delivery issued with respect to the delivered merchandise or article:

(1) Documents the transfer of that merchandise or article;

(2) Identifies such merchandise or article as being that to which a potential right to drawback exists; and

(3) Assigns such right to the transferee (see § 191.82 of this part).

(b) Required information. The certificate of delivery must include the following information:

(1) The party to whom the merchandise or articles are delivered;

(2) Date of delivery;

(3) Import entry number;

(4) Quantity delivered;

(5) Total duty paid on, or attributable to, the delivered merchandise;

(6) Date certificate was issued;

(7) Date of importation;

(8) Port where import entry filed;

(9) Person from whom received;

(10) Description of the merchandise delivered;

(11) The HTSUS number with a minimum of 6 digits, for the designated imported merchandise (such HTSUS number shall be from the entry summary and other entry documentation for the merchandise unless the issuer of the certificate of delivery received the merchandise under another certificate of delivery, or a certificate of manufacture and delivery, in which case such HTSUS number shall be from the other certificate); and

(12) If the merchandise transferred is substituted for the designated imported merchandise under 19 U.S.C. 1313(j)(2), the HTSUS or Schedule B commodity number, with a minimum of 6 digits.

(c) Intermediate transfer —

(1) Imported merchandise. If the imported merchandise was not delivered directly from the importer to the manufacturer, or from the importer to the exporter (or destroyer), each intermediate transfer of the imported merchandise shall be documented by means of a certificate of delivery issued in favor of the receiving party, and certified by the person through whose possession the merchandise passed.

(2) Manufactured article. If the article manufactured or produced under 19 U.S.C. 1313 (a) or (b) is not delivered directly from the manufacturer to the exporter (or destroyer), each transfer after the transfer from the manufacturer (which shall be documented by means of a certificate of manufacture and delivery) shall be documented by means of a certificate of delivery, issued in favor of the receiving party, and certified by the person through whose possession the article passed.

(d) Retention period; supporting records. Records supporting the information required on the certificate(s) of delivery, as listed in paragraph (b) of this section, must be retained by the issuing party for 3 years from the date of payment of the related claim or longer period if required by law (see 19 U.S.C. 1508(c)(3)).

(e) Retention; submission to Customs. The certificate of delivery shall be retained by the party to whom the merchandise or article covered by the certificate was delivered. Customs may request the certificate from the claimant for the drawback claim based upon the certificate (see §§ 191.51, 191.52). If the certificate is requested by Customs, but is not provided by the claimant, the part of the drawback claim dependent on that certificate will be denied.

(f) Warehouse transfer and withdrawals. The person in whose name merchandise is withdrawn from a bonded warehouse shall be considered the importer for drawback purposes. No certificate of delivery is required covering prior transfers of merchandise while in a bonded warehouse.

§ 191.11 Tradeoff.

(a) Exchanged merchandise. To comply with §§ 191.21 and 191.22 of this part, the use of domestic merchandise taken in exchange for imported merchandise of the same kind and quality (as defined in § 191.2(x)(1) of this part for purposes of 19 U.S.C. 1313(b)) shall be treated as use of the imported merchandise if no certificate of delivery is issued covering the transfer of the imported merchandise. This provision shall be known as tradeoff and is authorized by § 313(k) of the Act, as amended (19 U.S.C. 1313(k)).

(b) Requirements. Tradeoff must occur between two separate legal entities but it is not necessary that the entity exchanging the imported merchandise be the importer thereof. In addition, tradeoff must consist of an exchange of same kind and quality merchandise and nothing else (the exchange may be of different quantities of same kind and quality merchandise, but may not involve the payment or receipt of cash payments or other than same kind and quality merchandise). If the quantities of merchandise exchanged are different, the lesser quantity shall be the quantity available for drawback. If the quantity of domestic merchandise received is greater than the quantity of imported merchandise exchanged, the merchandise identified for drawback shall be the portion of the domestic merchandise equal to the quantity of imported merchandise which is first received.

(c) Application. Each would-be user of tradeoff, except those operating under an approved specific manufacturing drawback ruling covering substitution, must apply to the Entry Process and Duty Refunds Branch, Regulations and Rulings, Office of International Trade, CBP Headquarters, for a determination of whether the imported and domestic merchandise are of the same kind and quality. For those users manufacturing under substitution drawback, this request should be contained in the application for a specific manufacturing drawback ruling (§ 191.8). For those users manufacturing under a general manufacturing drawback ruling (§ 191.7), the request should be made by a separate letter.

[T.D. 98-16, 63 FR 11006, Mar. 5, 1998; 63 FR 15288, Mar. 31, 1998]

§ 191.12 Claim filed under incorrect provision.

A drawback claim filed pursuant to any provision of § 313 of the Act, as amended (19 U.S.C. 1313) may be deemed filed pursuant to any other provision thereof should the drawback office determine that drawback is not allowable under the provision as originally filed, but that it is allowable under such other provision. To be allowable under such other provision, the claim must meet each of the requirements of such provision. The claimant may raise alternative provisions prior to liquidation or by protest.

[T.D. 98-16, 63 FR 11006, Mar. 5, 1998; 63 FR 15288, Mar. 31, 1998]

§ 191.13 Packaging materials.

(a) Imported packaging material. Drawback of duties is provided in § 313(q)(1) of the Act, as amended (19 U.S.C. 1313(q)(1)), on imported packaging material when used to package or repackage merchandise or articles exported or destroyed pursuant to § 313(a), (b), (c), or (j) of the Act, as amended (19 U.S.C. 1313(a), (b), (c), or (j)). Drawback is payable on the packaging material pursuant to the particular drawback provision to which the packaged goods themselves are subject. The drawback will be based on the duty, tax or fee paid on the importation of the packaging material. The packaging material must be separately identified on the claim, and all other information and documents required for the particular drawback provision under which the claim is made shall be provided for the packaging material.

(b) Packaging material manufactured in United States from imported materials. Drawback of duties is provided in § 313(q)(2) of the Act, as amended (19 U.S.C. 1313(q)(2)), on packaging material that is manufactured or produced in the United States from imported materials and used to package or repackage articles that are exported or destroyed under § 313(a) or (b) of the Act, as amended (19 U.S.C. 1313(a) or (b)). Drawback is payable on the packaging material under the particular manufacturing drawback provision to which the packaged articles themselves are subject, either 19 U.S.C. 1313(a) or (b), as applicable. The drawback will be based on the duty, tax, or fee that is paid on the imported merchandise used to manufacture or produce the packaging material. The packaging material and the imported merchandise used in its manufacture or production must be separately identified on the claim, and all other information and documents required for the particular drawback provision under which the claim is made must be provided for the packaging material as well as the imported merchandise used in its manufacture or production, for purposes of determining the applicable drawback payable.

[T.D. 98-16, 63 FR 11006, Mar. 5, 1998, as amended by T.D. 02-16, 67 FR 16637, Apr. 8, 2002]

§ 191.14 Identification of merchandise or articles by accounting method.

(a) General. This section provides for the identification of merchandise or articles for drawback purposes by the use of accounting methods. This section applies to identification of merchandise or articles in inventory or storage, as well as identification of merchandise used in manufacture or production (see § 191.2(h) of this subpart). This section is not applicable to situations in which the drawback law authorizes substitution (substitution is allowed in specified situations under 19 U.S.C. 1313(b), 1313(j)(2), 1313(k), and 1313(p); this section does apply to situations in these subsections in which substitution is not allowed, as well as to the subsections of the drawback law under which no substitution is allowed). When substitution is authorized, merchandise or articles may be substituted without reference to this section, under the criteria and conditions specifically authorized in the statutory and regulatory provisions providing for the substitution.

(b) Conditions and criteria for identification by accounting method. Manufacturers, producers, claimants, or other appropriate persons may identify for drawback purposes lots of merchandise or articles under this section, subject to each of the following conditions and criteria:

(1) The lots of merchandise or articles to be so identified must be fungible (see § 191.2(o) of this part);

(2) The person using the identification method must be able to establish that inventory records (for example, material control records), prepared and used in the ordinary course of business, account for the lots of merchandise or articles to be identified as being received into and withdrawn from the same inventory. Even if merchandise or articles are received or withdrawn at different geographical locations, if such inventory records treat receipts or withdrawals as being from the same inventory, those inventory records may be used to identify the merchandise or articles under this section, subject to the conditions of this section. If any such inventory records (that is, inventory records prepared and used in the ordinary course of business) treat receipts and withdrawals as being from different inventories, those inventory records must be used and receipts into or withdrawals from the different inventories may not be accounted for together. If units of merchandise or articles can be specifically identified (for example, by serial number), the merchandise or articles must be specifically identified and may not be identified by accounting method, unless it is established that inventory records, prepared and used in the ordinary course of business, treat the merchandise or articles to be identified as being received into and withdrawn from the same inventory (subject to the above conditions);

(3) Unless otherwise provided in this section or specifically approved by Customs (by a binding ruling under part 177 of this chapter), all receipts (or inputs) into and all withdrawals from the inventory must be recorded in the accounting record;

(4) The records which support any identification method under this section are subject to verification by Customs (see § 191.61 of this part). If Customs requests such verification, the person using the identification method must be able to demonstrate how, under generally accepted accounting procedures, the records which support the identification method used account for all merchandise or articles in, and all receipts into and withdrawals from, the inventory, and the drawback per unit for each receipt and withdrawal; and

(5) Any accounting method which is used by a person for drawback purposes under this section must be used without variation with other methods for a period of at least one year, unless approval is given by Customs for a shorter period.

(c) Approved accounting methods. The following accounting methods are approved for use in the identification of merchandise or articles for drawback purposes under this section.

(1) First-in, first-out (FIFO) —

(i) General. The FIFO method is the method by which fungible merchandise or articles are identified by recordkeeping on the basis of the first merchandise or articles received into the inventory. Under this method, withdrawals are from the oldest (first-in) merchandise or articles in the inventory at the time of withdrawal.

(ii) Example. If the beginning inventory is zero, 100 units with $1 drawback attributable per unit are received in inventory on the 2nd of the month, 50 units with no drawback attributable per unit are received into inventory on the 5th of the month, 75 units are withdrawn for domestic (non-export) shipment on the 10th of the month, 75 units with $2 drawback attributable per unit are received in inventory on the 15th of the month, 100 units are withdrawn for export on the 20th of the month, and no other receipts or withdrawals occurred in the month, the drawback attributable to the 100 units withdrawn for export on the 20th is a total of $75 (25 units from the receipt on the 2nd with $1 drawback attributable per unit, 50 units from the receipt on the 5th with no drawback attributable per unit, and 25 units from the receipt on the 15th with $2 drawback attributable per unit). The basis of the foregoing and the effects on the inventory of the receipts and withdrawals, and balance in the inventory thereafter are as follows: On the 2nd of the month the receipt of 100 units ($1 drawback/unit) results in a balance of that amount; the receipt of 50 units ($0 drawback/unit) on the 5th results in a balance of 150 units (100 with $1 drawback/unit and 50 with $0 drawback/unit); the withdrawal on the 10th of 75 units ($1 drawback/unit) results in a balance of 75 units (25 with $1 drawback/unit and 50 with $0 drawback/unit); the receipt of 75 units ($2 drawback/unit) on the 15th results in a balance of 150 units (25 with $1 drawback/unit, 50 with $0 drawback/unit, and 75 with $2 drawback/unit); the withdrawal on the 20th of 100 units (25 with $1 drawback/unit, 50 with $0 drawback/unit, and 25 with $2 drawback unit) results in a balance of 50 units (all 50 with $2 drawback/unit).

(2) Last-in, first out (LIFO) —

(i) General. The LIFO method is the method by which fungible merchandise or articles are identified by recordkeeping on the basis of the last merchandise or articles received into the inventory. Under this method, withdrawals are from the newest (last-in) merchandise or articles in the inventory at the time of withdrawal.

(ii) Example. In the example in paragraph (c)(1)(ii) of this section, the drawback attributable to the 100 units withdrawn for export on the 20th is a total of $175 (75 units from the receipt on the 15th with $2 drawback attributable per unit and 25 units from the receipt on the 2nd with $1 drawback attributable per unit). The basis of the foregoing and the effects on the inventory of the receipts and withdrawals, and balance in the inventory thereafter are as follows: On the 2nd of the month the receipt of 100 units ($1 drawback/unit) results in a balance of that amount; the receipt of 50 units ($0 drawback/unit) on the 5th results in a balance of 150 units (100 with $1 drawback/unit and 50 with $0 drawback/unit); the withdrawal on the 10th of 75 units (50 with $0 drawback/unit and 25 with $1 drawback/unit) results in a balance of 75 units (all with $1 drawback/unit); the receipt of 75 units ($2 drawback/unit) on the 15th results in a balance of 150 units (75 with $1 drawback/unit and 75 with $2 drawback/unit); the withdrawal on the 20th of 100 units (75 with $2 drawback/unit and 25 with $1 drawback/unit) results in a balance of 50 units (all 50 with $1 drawback/unit).

(3) Low-to-high —

(i) General. The low-to-high method is the method by which fungible merchandise or articles are identified by recordkeeping on the basis of the lowest drawback amount per unit of the merchandise or articles in inventory. Merchandise or articles with no drawback attributable to them (for example, domestic merchandise or duty-free merchandise) must be accounted for and are treated as having the lowest drawback attributable to them. Under this method, withdrawals are from the merchandise or articles with the least amount of drawback attributable to them, then those with the next higher amount, and so forth. If the same amount of drawback is attributable to more than one lot of merchandise or articles, withdrawals are from the oldest (first-in) merchandise or articles among those lots with the same amount of drawback attributable. Drawback requirements are applicable to withdrawn merchandise or articles as identified (for example, if the merchandise or articles identified were attributable to an import more than 5 years (more than 3 years for unused merchandise drawback) before the claimed export, no drawback could be granted).

(ii) Ordinary —

(A) Method. Under the ordinary low-to-high method, all receipts into and all withdrawals from the inventory are recorded in the accounting record and accounted for so that each withdrawal, whether for export or domestic shipment, is identified by recordkeeping on the basis of the lowest drawback amount per unit of the merchandise or articles available in the inventory.

(B) Example. In this example, the beginning inventory is zero, and receipts into and withdrawals from the inventory are as follows:

| Date | Receipt

($ per unit) |

Withdrawals |

|---|---|---|

| Jan. 2 | 100 (zero) | |

| Jan. 5 | 50 ($1.00) | |

| Jan. 15 | 50 (export). | |

| Jan. 20 | 50 ($1.01) | |

| Jan. 25 | 50 ($1.02) | |

| Jan. 28 | 50 (domestic). | |

| Jan. 31 | 50 ($1.03) | |

| Feb. 5 | 100 (export). | |

| Feb. 10 | 50 ($.95) | |

| Feb. 15 | 50 (export). | |

| Feb. 20 | 50 (zero) | |

| Feb. 23 | 50 (domestic). | |

| Feb. 25 | 50 ($1.05) | |

| Feb. 28 | 100 (export). | |

| Mar. 5 | 50 ($1.06) | |

| Mar. 10 | 50 ($.85) | |

| Mar. 15 | 50 (export). | |

| Mar. 21 | 50 (domestic). | |

| Mar. 20 | 50 ($1.08) | |

| Mar. 25 | 50 ($.90) | |

| Mar. 31 | 100 (export). |

The drawback attributable to the January 15 withdrawal for export is zero (the available receipt with the lowest drawback amount per unit is the January 2 receipt), the drawback attributable to the January 28 withdrawal for domestic shipment (no drawback) is zero (the remainder of the January 2 receipt), the drawback attributable to the February 5 withdrawal for export is $100.50 (the January 5 and January 20 receipts), the drawback attributable to the February 15 withdrawal for export is $47.50 (the February 10 receipt), the drawback attributable to the February 23 withdrawal for domestic shipment (no drawback) is zero (the February 20 receipt), the drawback attributable to the February 28 withdrawal for export is $102.50 (the January 25 and January 31 receipts), the drawback attributable to the March 15 withdrawal for export is $42.50 (the March 10 receipt), the drawback attributable to the March 21 withdrawal for domestic shipment (no drawback) is $52.50 (the February 25 receipt), and the drawback attributable to the March 31 withdrawal for export is $98.00 (the March 25 and March 5 receipts). Remaining in inventory is the March 20 receipt of 50 units ($1.08 drawback/unit). Total drawback attributable to withdrawals for export in this example would be $391.00.

(iii) Low-to-high method with established average inventory turn-over period —

(A) Method. Under the low-to-high method with established average inventory turn-over period, all receipts into and all withdrawals for export are recorded in the accounting record and accounted for so that each withdrawal is identified by recordkeeping on the basis of the lowest drawback amount per available unit of the merchandise or articles received into the inventory in the established average inventory turn-over period preceding the withdrawal.

(B) Accounting for withdrawals (for domestic shipments and for export). Under this method, domestic withdrawals (withdrawals for domestic shipment) are not accounted for and do not affect the available units of merchandise or articles. All withdrawals for export must be accounted for whether or not drawback is available or claimed on the withdrawals. Once a withdrawal for export is made and accounted for under this method, the merchandise or articles withdrawn are no longer available for identification.

(C) Establishment of inventory turn-over period. For purposes of this section, average inventory turn-over period is based on the rate of withdrawal from inventory and represents the time in which all of the merchandise or articles in the inventory at a given time must have been withdrawn. To establish an average of this time, at least 1 year, or three (3) turn-over periods (if inventory turns over less than 3 times per year), must be averaged. The inventory turn-over period must be that for the merchandise or articles to be identified, except that if the person using the method has more than one kind of merchandise or articles with different inventory turn-over periods, the longest average turn-over period established under this section may be used (instead of using a different inventory turn-over period for each kind of merchandise or article).

(D) Example. In the example in paragraph (c)(3)(ii)(B) of this section (but, as required for this method, without accounting for domestic withdrawals, and with an established average inventory turn-over period of 30 days), the drawback attributable to the January 15 withdrawal for export is zero (the available receipt in the preceding 30 days with the lowest amount of drawback is the January 2 receipt, of which 50 units will remain after the withdrawal), the drawback attributable to the February 5 withdrawal for export is $101.50 (the January 20 and January 25 receipts), the drawback attributable to the February 15 withdrawal for export is $47.50 (the February 10 receipt), the drawback attributable to the February 28 withdrawal for export is $51.50 (the February 20 and January 31 receipts), the drawback attributable to the March 15 withdrawal for export is $42.50 (the March 10 receipt), and the drawback attributable to the March 31 withdrawal for export is $98.00 (the March 25 and March 5 receipts). No drawback may be claimed on the basis of the January 5 receipt or the February 25 receipt because in the case of each, there were insufficient withdrawals for export within the established average inventory turn-over period; the 50 units remaining from the January 2 receipt after the January 15 withdrawal are not identified for a withdrawal for export because there is no other withdrawal for export (other than the January 15 withdrawal) within the established average inventory turn-over period; the March 20 receipt (50 units at $1.08) is not yet attributed to withdrawals for export. Total drawback attributable to withdrawals for export in this example would be $341.00.

(iv) Low-to-high blanket method —

(A) Method. Under the low-to-high blanket method, all receipts into and all withdrawals for export are recorded in the accounting record and accounted for so that each withdrawal is identified by recordkeeping on the basis of the lowest drawback amount per available unit of the merchandise or articles received into inventory in the period preceding the withdrawal equal to the statutory period for export under the kind of drawback involved (e.g., 180 days under 19 U.S.C. 1313(p), 3 years under 19 U.S.C. 1313(c) and 1313(j), and 5 years otherwise under 19 U.S.C. 1313(i)). Drawback requirements are applicable to withdrawn merchandise or articles as identified (for example, if the merchandise or articles identified were attributable to an import more than 5 years (more than 3 years for 19 U.S.C. 1313(j); more than 180 days after the date of import or after the close of the manufacturing period for 19 U.S.C. 1313(p)) before the claimed export, no drawback could be granted).

(B) Accounting for withdrawals (for domestic shipments and for export). Under this method, domestic withdrawals (withdrawals for domestic shipment) are not accounted for and do not affect the available units of merchandise or articles. All withdrawals for export must be accounted for whether or not drawback is available or claimed on the withdrawals. Once a withdrawal for export is made and accounted for under this method, the merchandise or articles withdrawn are no longer available for identification.

(C) Example. In the example in paragraph (c)(3)(ii)(B) of this section (but, as required for this method, without accounting for domestic withdrawals), the drawback attributable to the January 15 withdrawal for export is zero (the available receipt in the inventory with the lowest amount of drawback is the January 2 receipt, of which 50 units will remain after the withdrawal), the drawback attributable to the February 5 withdrawal for export is $50.00 (the remainder of the January 2 receipt and the January 5 receipt), the drawback attributable to the February 15 withdrawal for export is $47.50 (the February 10 receipt), the drawback attributable to the February 28 withdrawal for export is $50.50 (the February 20 and January 20 receipts), the drawback attributable to the March 15 withdrawal for export is $42.50 (the March 10 receipt), and the drawback attributable to the March 31 withdrawal for export is $96.00 (the March 25 and January 25 receipts). Receipts not attributed to withdrawals for export are the January 31 (50 units at $1.03), February 25 (50 units at $1.05), March 5 (50 units at $1.06), and March 20 (50 units at $1.08) receipts. Total drawback attributable to withdrawals for export in this example would be $286.50.

(4) Average —

(i) General. The average method is the method by which fungible merchandise or articles are identified on the basis of the calculation by recordkeeping of the amount of drawback that may be attributed to each unit of merchandise or articles in the inventory. In this method, the ratio of:

(A) The total units of a particular receipt of the fungible merchandise in the inventory at the time of a withdrawal to;

(B) The total units of all receipts of the fungible merchandise (including each receipt into inventory) at the time of the withdrawal;

(C) Is applied to the withdrawal, so that the withdrawal consists of a proportionate quantity of units from each particular receipt and each receipt is correspondingly decreased. Withdrawals and corresponding decreases to receipts are rounded to the nearest whole number.

(ii) Example. In the example in paragraph (c)(1)(ii) of this section, the drawback attributable to the 100 units withdrawn for export on the 20th is a total of $133 (50 units from the receipt on the 15th with $2 drawback attributable per unit, 33 units from the receipt on the 2nd with $1 drawback attributable per unit, and 17 units from the receipt on the 5th with $0 drawback attributable per unit). The basis of the foregoing and the effects on the inventory of the receipts and withdrawals, and balance in the inventory thereafter are as follows: On the 2nd of the month the receipt of 100 units ($1 drawback/unit) results in a balance of that amount; the receipt of 50 units ($0 drawback/unit) on the 5th results in a balance of 150 units (100 with $1 drawback/unit and 50 with $0 drawback/unit); the withdrawal on the 10th of 75 units (50 with $1 drawback/unit (applying the ratio of 100 units from the receipt on the 2nd to the total of 150 units at the time of withdrawal) and 25 with $0 drawback/unit (applying the ratio of 50 units from the receipt on the 5th to the total of 150 units at the time of withdrawal)) results in a balance of 75 units (with 50 with $1 drawback/unit and 25 with $0 drawback/unit, on the basis of the same ratios); the receipt of 75 units ($2 drawback/unit) on the 15th results in a balance of 150 units (50 with $1 drawback/unit, 25 with $0 drawback/unit, and 75 with $2 drawback/unit); the withdrawal on the 20th of 100 units (50 with $2 drawback/unit (applying the ratio of the 75 units from the receipt on the 15th to the total of 150 units at the time of withdrawal), 33 with $1 drawback/unit (applying the ratio of the 50 units remaining from the receipt on the 2nd to the total of 150 units at the time of withdrawal, and 17 with $0 drawback/unit (applying the ratio of the 25 units remaining from the receipt on the 5th to the total of 150 units at the time of withdrawal)) results in a balance of 50 units (25 with $2 drawback/unit, 17 with $1 drawback/unit, and 8 with $0 drawback/unit, on the basis of the same ratios).

(5) Inventory turn-over for limited purposes. A properly established average inventory turn-over period, as provided for in paragraph (c)(3)(iii)(C) of this section, may be used to determine:

(i) The fact and date(s) of use in manufacture or production of the imported designated merchandise and other (substituted) merchandise (see 19 U.S.C. 1313(b)); or

(ii) The fact and date(s) of manufacture or production of the finished articles (see 19 U.S.C. 1313(a) and (b)).

(d) Approval of other accounting methods.

(1) Persons proposing to use an accounting method for identification of merchandise or articles for drawback purposes which has not been previously approved for such use (see paragraph (c) of this section), or which includes modifications from the methods listed in paragraph (c) of this section, may seek approval by Customs of the proposed accounting method under the provisions for obtaining an administrative ruling (see part 177 of this chapter). The conditions applied and the criteria used by Customs in approving such an alternative accounting method, or a modification of one of the approved accounting methods, will be the criteria in paragraph (b) of this section, as well as those in paragraph (d)(2) of this section.

(2) In order for a proposed accounting method to be approved by Customs for purposes of this section, it shall meet the following criteria:

(i) For purposes of calculations of drawback, the proposed accounting method must be either revenue neutral or favorable to the Government; and

(ii) The proposed accounting method should be:

(A) Generally consistent with commercial accounting procedures, as applicable for purposes of drawback;

(B) Consistent with inventory or material control records used in the ordinary course of business by the person proposing the method; and

(C) Easily administered by both Customs and the person proposing the method.

[T.D. 98-16, 63 FR 11006, Mar. 5, 1998; 63 FR 15288, Mar. 31, 1998; 63 FR 27489, May 19, 1998]

§ 191.15 Recordkeeping.

Pursuant to 19 U.S.C. 1508(c)(3), all records which pertain to the filing of a drawback claim or to the information contained in the records required by 19 U.S.C. 1313 in connection with the filing of a drawback claim shall be retained for 3 years after payment of such claims or longer period if required by law (under 19 U.S.C. 1508, the same records may be subject to a different period for different purposes).

Subpart B - Manufacturing Drawback

§ 191.21 Direct identification drawback.

Section 313(a) of the Act, as amended (19 U.S.C. 1313(a)), provides for drawback upon the exportation, or destruction under Customs supervision, of articles which are not used in the United States prior to their exportation or destruction, and which are manufactured or produced in the United States wholly or in part with the use of particular imported, duty-paid merchandise and/or drawback product(s). Where two or more products result, drawback shall be distributed among the products in accordance with their relative value (see § 191.2(u)) at the time of separation. Merchandise may be identified for drawback purposes under 19 U.S.C. 1313(a) in the manner provided for and prescribed in § 191.14 of this part.

§ 191.22 Substitution drawback.

(a) General. If imported, duty-paid, merchandise and any other merchandise (whether imported or domestic) of the same kind and quality are used in the manufacture or production of articles within a period not to exceed 3 years from the receipt of the imported merchandise by the manufacturer or producer of the articles, then upon the exportation, or destruction under Customs supervision, of any such articles, without their having been used in the United States prior to such exportation or destruction, drawback is provided for in § 313(b) of the Act, as amended (19 U.S.C. 1313(b)), even though none of the imported, duty-paid merchandise may have been used in the manufacture or production of the exported or destroyed articles. The amount of drawback allowable cannot exceed that which would have been allowable had the merchandise used therein been the imported, duty-paid merchandise. For purposes of drawback of internal revenue tax imposed under Chapters 32, 38, 51, and 52 of the Internal Revenue Code of 1986, as amended (IRC), drawback granted on the export or destruction of substituted merchandise will be limited to the amount of taxes paid (and not returned by refund, credit, or drawback) on the substituted merchandise.

(b) Use by same manufacturer or producer at different factory. Duty-paid merchandise or drawback products used at one factory of a manufacturer or producer within 3 years after the date on which the material was received by the manufacturer or producer may be designated as the basis for drawback on articles manufactured or produced in accordance with these regulations at other factories of the same manufacturer or producer.

(c) Designation. A manufacturer or producer may designate any eligible imported merchandise or drawback product which it has used in manufacture or production.

(d) Designation by successor; 19 U.S.C. 1313(s) —

(1) General rule. Upon compliance with the requirements in this section and under 19 U.S.C. 1313(s), a drawback successor as defined in paragraph (d)(2) of this section may designate merchandise or drawback product used by a predecessor before the date of succession as the basis for drawback on articles manufactured or produced by the successor after the date of succession.

(2) Drawback successor. A “drawback successor” is a manufacturer or producer to whom another entity (predecessor) has transferred, by written agreement, merger, or corporate resolution:

(i) All or substantially all of the rights, privileges, immunities, powers, duties, and liabilities of the predecessor; or

(ii) The assets and other business interests of a division, plant, or other business unit of such predecessor, provided that the value of the transferred assets and interests (realty, personalty, and intangibles, exclusive of the drawback rights) exceeds the value of such drawback rights, whether vested or contingent.

(3) Certifications and required evidence —

(i) Records of predecessor. The predecessor or successor must certify that the successor is in possession of the predecessor's records which are necessary to establish the right to drawback under the law and regulations with respect to the merchandise or drawback product.

(ii) Merchandise not otherwise designated. The predecessor or successor must certify in an attachment to the claim, that the predecessor has not designated and will not designate, nor enable any other person to designate, such merchandise or product as the basis for drawback.

(iii) Value of transferred property. In instances in which assets and other business interests of a division, plant, or other business unit of a predecessor are transferred, the predecessor or successor must specify, and maintain supporting records to establish, the value of the drawback rights and the value of all other transferred property.

(iv) Review by Customs. The written agreement, merger, or corporate resolution, provided for in paragraph (d)(2) of this section, and the records and evidence provided for in paragraph (d)(3) (i) through (iii) of this section, must be retained by the appropriate party(s) for 3 years from the date of payment of the related claim and are subject to review by Customs upon request.

(e) Multiple products —

(1) General. Where two or more products are produced concurrently in a substitution manufacturing operation, drawback shall be distributed to each product in accordance with its relative value (see § 191.2(u)) at the time of separation.

(2) Claims covering a manufacturing period. Where the claim covers a manufacturing period rather than a manufacturing lot, the entire period covered by the claim is the time of separation of the products and the value per unit of product is the market value for the period (see § 191.2(u) of this part). Manufacturing periods in excess of one month may not be used without specific approval of Customs.

(3) Recordkeeping. Records shall be maintained showing the relative value of each product at the time of separation.

[T.D. 98-16, 63 FR 11006, Mar. 5, 1998, as amended by USCBP-2018-0029, 83 FR 65064, Dec. 18, 2018]

§ 191.23 Methods of claiming drawback.

(a) Used in. Drawback may be paid based on the amount of the imported or substituted merchandise used in the manufacture of the exported article, where there is no waste or the waste is valueless or unrecoverable. This method must be used when multiple products also necessarily and concurrently result from the manufacturing process, and there is no valuable waste (see paragraph (c) of this section).

(b) Appearing in. Drawback is allowable under this method based only on the amount of imported or substituted merchandise that appears in (is contained in) the exported articles. This method may not be used if there are multiple products also necessarily and concurrently resulting from the manufacturing process.

(c) Used in less valuable waste. Drawback is allowable under this method based on the quantity of merchandise or drawback products used to manufacture the exported or destroyed article, reduced by an amount equal to the quantity of this merchandise that the value of the waste would replace. This method must be used when multiple products also necessarily and concurrently result from the manufacturing process, and there is valuable waste.